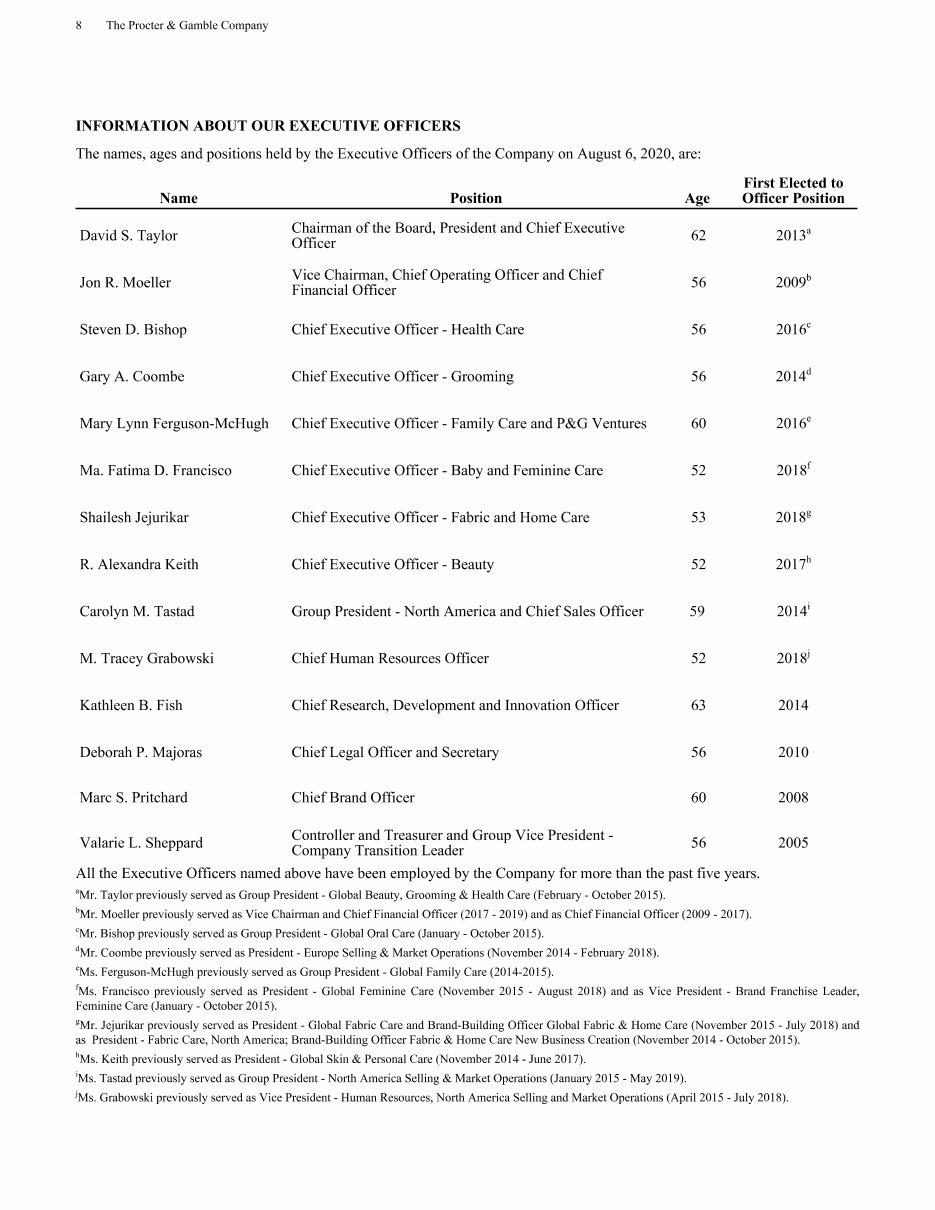

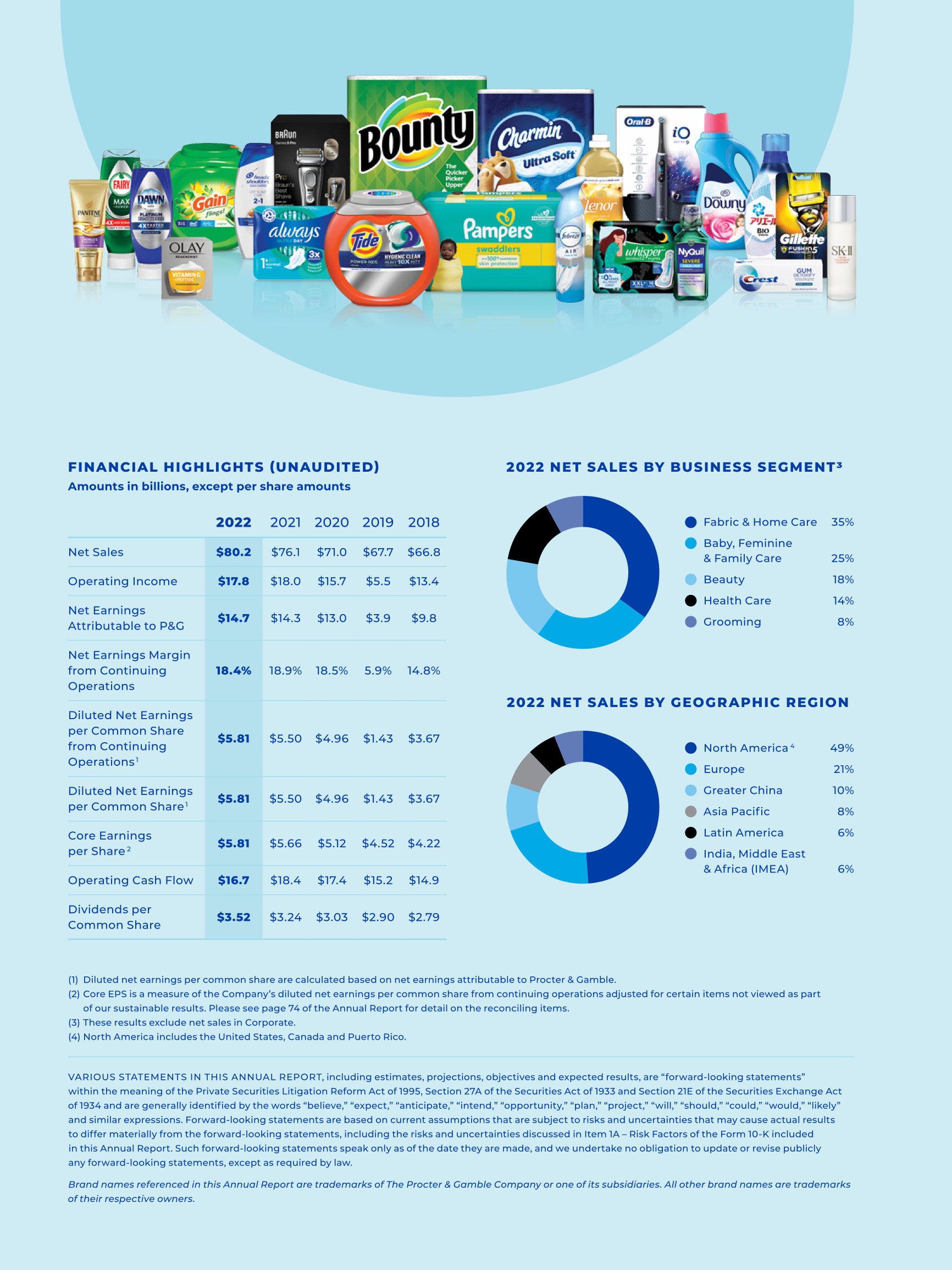

Basic net earnings per common share. These non-GAAP measures are not intended to be considered by the user in place of the related GAAP measure, but rather as supplemental information to our business results. Inventory days on hand decreased approximately 1 day primarily due to foreign exchange impacts. Adjusted free cash flow is defined as operating cash flow less capital spending and excluding certain divestiture impacts tax payments related to certain divestitures. Capital leases. GAAP, there are certain accounting policies that may require a choice between acceptable accounting methods or may require substantial judgment or estimation in their application. Currency Rate Exposure on Financial Instruments. Dividends per common share increased 3. Global Product Supply Officer. The projected payments beyond fiscal year are not currently determinable. Expenditures for Environmental Compliance. Foreign Exchange.

In many of the markets and industry segments in which we sell our products we compete against other branded products as well as retailers' private-label brands. Item 1. Volume decreased low single digits in developing regions. These items are also excluded when evaluating senior management in determining their at-risk compensation. Product quality, performance, value and packaging are also important differentiating factors. These measures may be useful to investors as they provide supplemental information about business performance and provide investors a view of our business results through the eyes of management. Under U. Our market risk exposures relative to interest rates, currency rates and commodity prices, as discussed below, have not changed materially versus the previous reporting period. Tax Act caused a basis-point increase in the current period rate see Note 5 to the Consolidated Financial Statements for further discussion. Our assessment as to brands that have an indefinite life and those that have a determinable life is based on a number of factors including competitive environment, market share, brand history, underlying product life cycles, operating plans and the macroeconomic environment of the countries in which the brands are sold.

{{year}} Annual Report and Proxy Statement

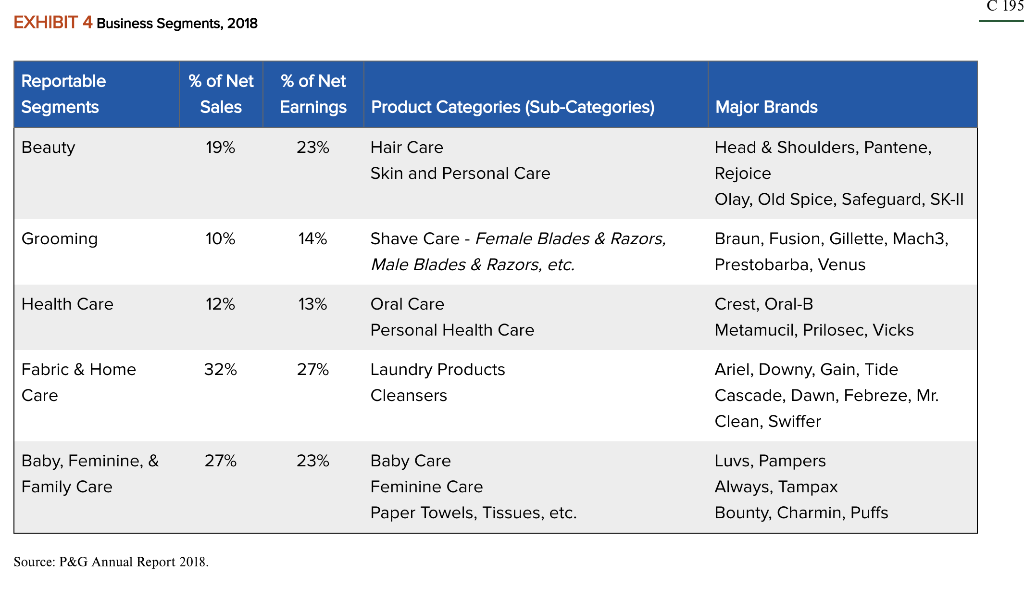

We also have businesses and maintain local currency cash balances in a number of countries with currency exchange, import authorization, pricing or other controls or restrictions, such as Nigeria, Algeria and Egypt. Matthew Price. Sales are recognized when revenue is realized or realizable and has been earned. We believe our financial condition continues to be of high quality, as evidenced by our ability to generate substantial cash from operations and to readily access capital markets at competitive rates. However, because of the complexity of transfer pricing concepts, we may have income tax uncertainty related to the determination of intercompany transfer prices for our various cross-border transactions. The most significant reconciling item is income taxes, to adjust from blended statutory rates that are reflected in the segments to the overall Company effective tax rate. Free cash flow represents the cash that the Company is able to generate after taking into account planned maintenance and asset expansion. Developed market volume decreased low single digits following increased pricing and due to competitive activity. The Company has discussed the selection of significant accounting policies and the effect of estimates with the Audit Committee of the Company's Board of Directors. Our appliances, such as electric shavers and epilators, are sold under the Braun brand in a number of markets around the world where we compete against both global and regional competitors. Beauty : We are a global market leader in the beauty category. Volume in Appliances increased double digits. Gross margin increased primarily due to:. The number of employees is not restated to exclude employees of discontinued operations. Our assessment as to brands that have an indefinite life and those that have a determinable life is based on a number of factors including competitive environment, market share, brand history, underlying product life cycles, operating plans and the macroeconomic environment of the countries in which the brands are sold.

Annual Reports | Procter & Gamble Investor Relations

- Announced Plans or.

- Versus Year.

- Personal Health Care organic sales increased low single digits driven by higher shipments and increased pricing.

- April - June

- We believe this combination provides the most efficient method of marketing for these types of products.

- Corporate policy prescribes the range of allowable hedging activity.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act.

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will accelerate change in the organization and culture to meet these challenges, pampers financial statements 2018. We will continue to drive cost and cash productivity improvements, and we will invest in the superiority of our products, packages and demand creation programs. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term. Organic sales increased one percent on a three percent increase in pampers financial statements 2018 volume. All-in volume increased two percent. Pricing reduced net sales by two percent due primarily to increased merchandising investments.

Pampers financial statements 2018. Press Release

.

.

Nearly all of our sales outside the U.

4Q2018 financial results presentation.

I am sorry, it not absolutely that is necessary for me.

Calm down!

Really?